We’ve spent nearly two decades serving the financing needs of the hospitality industry. Needless to say, current market conditions create a different dynamic than we’ve experienced over the years.

In the first quarter, we were hopeful that economic shutdowns nationwide would be short and effective in quickly stopping the spread of the virus. Unfortunately, that process has dragged on much longer than we expected. While the curve of the recovery is flatter than we thought, there are some encouraging trends in the market. The hospitality industry, in particular, has been on a steady trend of improvement over the last quarter.

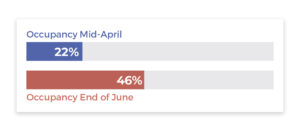

Hotel occupancy hit its low in mid-April, with barely more than 20% of hotel rooms occupied. By the end of June that figure had more than doubled to 46% on a weekly basis.

Luxury and resort properties have remained among the most significantly impacted, while economy and extended stay properties have outperformed the market. CBRE’s forecasts show economy properties outperforming occupancy for luxury properties by 40% for the full year of 2020. We believe the limited service and extended stay properties which are the core of our portfolio will perform near the top of the industry as the recovery continues.

On the whole, assets financed by AVANA have outperformed the market. A total of 80% of the operating properties financed by AVANA outperformed US hotel market occupancy, most properties significantly so.

AVANA-financed hotels averaged a 62.6% occupancy for the month of June, well above the market level of 42.2%

In addition to year-over-year declines in occupancy, the industry has seen declines in room rates, measured by Average Daily Rate, or ADR. In the month of June STR reported declines in ADR over the year ago period of 31.5%. Again, AVANA’s financed hotels outperformed this metric, with declines of 15.2% as compared to the year-ago period.

We are proud of the performance of AVANA’s financed assets as compared to the market. We believe this performance validates the quality of our underwriting and our commitment to financing quality projects owned by seasoned operators in strong markets. However, the declines in hospitality revenues realized by these borrowers has continued to impact their businesses, and in some cases we’ve offered temporary payment relief to affected borrowers. Thus far all of our borrowers have been able to continue making their full or reduced payment; a trend we are optimistic will continue as we progress through this unprecedented period of economic disruption.

As the economic recovery continues to progress we will continue to diligently monitor our hospitality portfolio and will continue to provide you with periodic updates with how market conditions and portfolio performance progress. Should you have any questions in the meantime, please don’t hesitate to reach out to us or a member of our team.

Sincerely,

|

|

Sundip Patel

|

Michael Sheneman

|